| Kaiser Watch April 26, 2024: Is a Colonial Coal buyout imminent? |

| Jim (0:00:00): Is Colonial Coal any closer to getting bought out for its metallurgical coal assets in northeastern British Columbia? |

This is the third year in a row that I have had David Austin's Colonial Coal International Corp as a KRO Favorite based on the expectation that it will receive a buyout offer in the $5-$10 range based on its 100% owned Huguenot and Flatbed projects in northeastern British Columbia. Colonial Coal took these projects through the PEA stage of feasibility demonstration in 2018 and 2019 using 1.30:1 CAD-USD exchange rate and metallurgical coal base case prices of USD $172/t and $164.80/t for Huguenot and Flatbed respectively. At a 7.5% discount rate that generated an after-tax net present value of CAD $1,516 million for Huguenot and CAD $898 million for Flatbed. During 2023 Teck averaged USD $297/t for its metallurgical coal production, nearly double Colonial Coal's base case price. The cost assumptions of the PEAs will need to be updated to reflect the post-covid inflation, so if one trades off the higher cost with the higher price of metallurgical coal it is reasonable to take the combined PEA NPV of CAD $2.4 billion seriously, which, based on 194 million shares fully diluted, translates into $12.44 per share. Contemplating a buyout in the $5-$10 range is thus a reasonable speculation.

Since completing the PEAs Colonial Coal's chairman and CEO David Austin has been shopping the company around for a buyout by a steelmaker in need of security of supply. Coal is a dirty word these days and most people do not understand the difference between metallurgical and thermal coal, causing some metallurgical coal producers such as Teck to prefer calling it "steel-making coal" so as not to get tarnished by the anti-fossil fuel brush. Metallurgical coal is used in making steel from iron, and this process does generate carbon dioxide emissions just as does the burning of thermal coal to generate energy. In fact steelmaking contributes about 7%-8% of global CO2 emissions. There are alternative ways to make steel, but they are substantially more expensive and the world is not ready for higher steel costs, especially Global South nations such as India and Global East nations such as China. Steelmakers in jurisdictions where it matters deal with their CO2 emissions by purchasing carbon offsets.

There are, however, energy alternatives to thermal coal which have zero carbon dioxide emissions and are non-polluting such as renewables and nuclear. Even worse for thermal coal is the fact that natural gas which is non-polluting not only generates less carbon dioxide per energy unit than thermal coal, but in places like North America is cheaper than coal. Unfortunately there are countries like China and Indonesia which have abundant coal and little interest in the cost of mitigating CO2 emissions and other pollutants generated by burning coal (in steel-making whatever other elements are present in metallurgical coal either end up in the steel or the slag). The global nickel market is now under pressure because Indonesia is happy to burn dirty coal as its source of energy for extracting nickel from its laterite ore.

Even though there is a distinction between metallurgical and thermal coal, companies such as Teck which produce both base metals and metallurgical coal are penalized by investors who want their portfolio to exclude exposure to fossil fuels that generate carbon dioxide. In February 2023 Teck proposed to split itself into two companies, Teck Metals Corp which would hold all the base metal operations, and Elk Valley Resources Ltd which would hold its Canadaian metallurgical coal operations. In April 2023 Teck disclosed that it had received and rejected an unsolicited paper bid from Glencore which valued Teck at USD $22.5 billion. Glencore's plan was to combine Teck's metallurgical coal division with its own thermal coal division (26 mines) and split that off into a separate company so that Teck shareholders would end up with shares of Glencore holding the base metal and oil operations and shares of the coal spinout.

In December 2022 Glencore's effort to permit the Sukunka metallurgical coal project in northeastern BC was definitively rejected, which raised hopes that in 2023 Glencore might consider a bid for Colonial Coal's projects which do not have similar caribou habitat and First Nations issues. That hope faded when Glencore decided to go after a much bigger prize. A week after Teck's initial rejection Glencore came back with a revised bid that allowed Teck shareholders to opt for cash instead of stock in the coal spinout, which Teck management also rejected as undervaluing the company. Unfortunately for management a few weeks later its own shareholders rejected the proposal to split Teck into separate base metal and coal companies. In November 2023 Teck agreed to sell its coal division to Glencore for USD $6.9 billion. That transaction is expected to close in Q3 of 2024 if it receives regulatory approval.

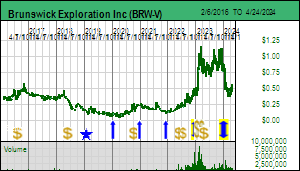

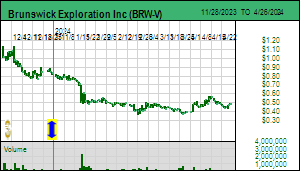

Colonial Coal has traded in a $2.00-$2.50 range so far this year on daily volume ranging 50,000 to 150,000 shares but has not issued any meaningful press releases since December 2022 when the stock was being trashed in the wake of the negative Sukunka decision which the market interpreted as a thumbs down for all future metallurgical coal mines in northeastern British Columbia. I discussed the fallout from the Sukunka denial in KW Episode January 26, 2023. On Friday April 26 the stock jumped $0.52 to $2.69 on 459,300 shares, the biggest move and volume in more than a year. This prompted some KRO members who follow Colonial Coal to speculate in my Slack forum if somebody was front-running an imminent buyout offer.

Unlike the base and precious metals sector where a producer cannot offer too big a premium for a resource junior with an advanced project, which is a problem for many juniors trapped in this endless bear market lacking the sort of institutional audience which has the firepower to lift a stock into the desired buyout range, potential bidders for strategic assets involving less conventional metals and minerals do not have this problem. Is Colonial Coal any closer to a buyout?

Today's move was not caused by traders front-running inside information but rather by informal news that Citi Bank has agreed to become Colonial Coal's advisor with regard to a potential buyout. Citi Bank is the sort of entity that advises Glencore scale companies, not Canadian listed resource juniors. This does not mean a buyout is imminent, but it does mean that the expressions of interest David Austin has been receiving from tire kickers during the past few years may have become serious. Indian steelmakers have been a source of potential interest, but things like Trudeau's spat with Modi about Sikh assassinations chilled that potential last year. But now that Glencore's acquisition of Teck's metallurgical coal assets is plodding through regulatory approval, it may have dawned on potential bidders that Glencore itself might seek to expand its metallurgical coal production capacity in Teck's backyard. There could be a new sense of urgency to move sooner than later. |

Colonial Coal International Corp (CAD-V)

Favorite

Fair Spec Value |

|

|

| Huguenot |

Canada - British Columbia |

6-Prefeasibility |

CM |

General Map showing locations of Huguenot and Flatbed projects in NE BC |

Map showing locations of met coal mines in NE BC |

Highlights of 2018 PEA for Huguenot |

Highlights of 2018 PEA for Flatbed |

| Jim (0:12:40): What did Brunswick's first results for winter drilling at Mirage tell us? |

When Brunswick Exploration Inc released initial drill results on April 25, 2024 for its winter drill program at Mirage I was taken aback by the nature of the disclosures which seemed to suggest that Mirage was shaping up to be little more than a mirage. What struck me as odd was that although Brunswick drilled 35 holes during the winter program, I could only count 22 holes on the drill plan the company provided. And except for the 4 holes for which assays were reported, none of the other new hole locations had numbers. Since the company follows the practice of numbering holes in the sequence drilled following the prior year's holes, which totaled 36 holes, I expected to see holes #37-#71 on the map. On the assumption that holes are logged and shipped for assaying in the order completed, I was surprised that the press release included assays for holes 49, 57, 58 and 60. What were the results for 37-48, 50-56 and 59? Were they blanks or very short intervals or low grades, with the result that Brunswick only reported 4 holes, of which #57 and #58 were not exciting at all? Fortunately Brunswick's CEO Killian Charles did return my call and provided plausible explanations for the strange appearance which has left me bullish that when the final results arrive over the next month or so the scale of Mirage will have increased from last year, with plenty of further growth left when drilling resumes in July.

First off, the 22 drill holes marked on the drill plan map are actually drill pad locations, some of which had several holes drilled at different angles but in the same direction. This makes it impossible to show the traces since they stack on top of each, which is why we saw only one drill hole trace per "pad". They did not number the holes not yet assayed because it would have made the drill plan far too busy. The "hole" pattern we see is complete.

They also had two rigs until the end of March, and although they are following last year's numbering sequence (ie last hole is #71), we could not infer anything from the numbering in terms of what they were seeing in the field and responding to as far as which pad the rig goes to next. A rig may have problems with a hole while the other rig has none, and since they are drilling in different areas the numbering sequence reveals no information as would be the case when a company is using a single rig as a vectoring tool probing the third dimension and deciding on that basis where to drill next.

With regard to why assays were reported first for holes 49, 57, 58 and 60, they had some logistical issues with the shipping order, so that it is not a case of first drilled first assayed. However, #60 which steps 250 m northeast of last year's MR6 dyke limit at the boundary of the inlier claims optioned 75% from Electric Elements and for which Brunswick recently bought out the 0.5% royalty Sirios Resources Inc acquired when it sold those claims to Virginia Mines, was important and I believe was given priority. The reason it was important is that they wanted to chase the MR6 dyke northeast by drilling through the ice. There is a narrow northeast oriented lake which has bulges at the southwestern and northeastern ends which makes it look like a barbell. As it turned out, winter was warmer than expected, and the drill crew's efforts at ice thickening never achieved a comfort zone.

The 6 holes within the area I have highlighted with a blue circle are within the inlier claims and ended up being drilled from shore. This batch of holes are the most important in terms of expanding the scale of the discovery because it extends the strike of the "central" zone (MR3 & MR6) 1 km to the northeast. Killian resisted my efforts to tease out confirmation that drilling in this direction was successful beyond #60 which had two intervals of 18.4 m at 1.03% Li2O and 31.6 m of 1.71% Li2O, but in the next sentence he was talking about the outcrop 3 km to the northeast on 100% owned ground which is on dry land that can be drilled during the summer. If the dyke is confirmed under the lake they will consider barge drilling this summer.

He has also confirmed my conclusion that they see the lake separating the "north" and "central" zone has an anticlinal fold axis for what was once a continuous dyke but which has now been split into north and south limbs, with the north limb dipping north and the south limb dipping south. The southern limb has a shallow dip, so those holes I have circled in orange are potentially important. With regard to the 200 m gap between MR 3 and MR6 which each have a small stepout fence of holes, the reason they did not infill this gap was because it can be drilled during the summer. The focus during the winter was to test targets where access during winter is easier.

When I talked to Bob Wares at VRIC in Vancouver he was dismissive of geophysics as useless for targeting pegmatites, including gravity which Winsome claims has been very helpful. He still is of this view, but Killian told me that in late January they started doing gravity and that the area drilled by #60 has a gravity low, so the team is of a different opinion from Bob. The test will come later this summer when they tackle the barbell at the southwestern end of the lake which has a similar shape to that at the northeastern end on the inlier claims where I have my fingers crossed about those 6 holes in the blue circle. And it has a similar gravity low anomaly. A skeptic like Bob would argue that lakes distort gravity data and the correlation of the dyke with a gravity low is just coincidence.

When Killian mentioned they were eager to test the southwestern barbell this summer because of the gravity low, I pointed out that the most recent map they published showing the location of outcrops and boulders shows nothing down ice from this target. Killian explained that this area is largely overburden covered but they did find spodumene bearing boulders, just not giant ones like within the 3.5 km train of micaceous pegmatite I have circled in green.

As far as this 3.5 km boulder train is concerned, the last two holes of the season are those southwest of the "south" zone (MR-4 dyke) and were drilled in opposite directions as scout holes at what is the head of the micaceous bolder train. Killian would not say what was hit, but elsewhere in our chat he declared they still have not intersected pegmatite or sampled outcrop whose mineralogy explains that of the micaceous boulder field. The mystery of its origin will be given a hard look this summer, and remains a potential blockbuster discovery.

As far as weather is concerned, although this was a warm winter and the geese have started heading north early, causing the Cree to scramble to get in position for the annual goose hunt, unlike last year this has been a typical moist winter. While things can still go dry in May and June, the risk of huge forest fires is lower this year. One issue is that in some locations where the peat caught fire these fires smoldered through winter. But the authorities are aware of these locations and are monitoring closely for flareups. Brunswick expects to report assays for the remaining holes in bigger batches during May and plans to have boots on the ground in June to further prospect Mirage after getting kicked out last year in early June due to fire closures, with drilling at Mirage to resume in July for what promises to be a very busy exploration season. |

Brunswick Exploration Inc (BRW-V)

Favorite

Fair Spec Value |

|

|

| Mirage |

Canada - Quebec |

3-Discovery Delineation |

Li |

Drill Plan of Winter Drilling with Fold Axis |

Mirage Assays reported April 25, 2024 |

Plan and Section of MR-6 Dyke |

Topo Drill Plan from 2023 compared to 2024 Drill Plan |

Comparing 2023 Boulder-Outcrop Map with 2024 Drill Plan |

| Disclosure: JK owns shares of Brunswick; Brunswick and Colonial Coal are Fair Spec Value rated Favorites |