Home / Research Tools

Research Tools

| | Corporate Profile: Uranerz Energy Corp

Publisher: Kaiser Research Online

Author: Copyright 2009 John A Kaiser

|

| |

Uranerz Energy Corp (URZ-T)

| Uranerz Energy is a Glen Catchpole led uranium developer focused on Wyoming, where it controls several permitting-stage properties that are collectively known as the Powder River project. The company plans to create a central processing facility at its Nichols Ranch property and a satellite ion-exchange facility at its Hank property. The ultimate production level from these two properties is planned to be in the range of 600,000 to 750,000 pounds per year U3O8, and the company has targeted production for 2011. Uranerz has also commenced preparation of environmental permit and licence applications for its planned third ISR uranium mining unit in the central Powder River basin (PRB,) the Jane Dough unit which includes the Doughstick, South Doughstick and North Jane properties. |

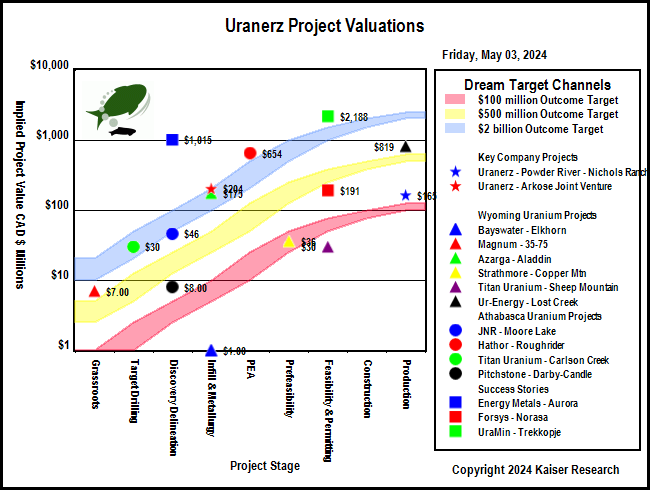

Key to Understanding IPV Charts and Spec Value Hunter Tables

| An IPV Chart is a graphical presentation of a Spec Value Hunter table that has been constructed according to the Rational Speculation Model developed by John Kaiser. The IPV Chart allows speculators to identify which projects offer poor, fair or good speculative value in both absolute and relative terms. The speculative value depends on the project stage, the project's implied value as calculated by the company's fully diluted capitalization, stock price and net project interest, and the dream target deemed appropriate for the project. A dream target is what a project would be worth in discounted cash flow terms once in production. |

| Green background indicates the dream target judged appropriate for this play by John Kaiser - otherwise unranked. |

Poor Speculative Value -   |

Fair Speculative Value -  |

Good Speculative Value -   |

Note:   narrow arrows indicate IPV is outside the fair value channel but within 25% of the fair value limits narrow arrows indicate IPV is outside the fair value channel but within 25% of the fair value limits |

| Click on the company name to view the company profile, the project name to view project details. |

| Click on the project icon if its background is shaded to get the IPV Chart for that company. |

|

| |

| | You can return to the Top of this page

|

|