| Kaiser Watch February 23, 2024: Is the AI dream good for resource juniors? |

| Jim (0:00:00): What do you have in store for the upcoming Metals Investor Forum in Toronto? |

The Metals Investor Forum runs March 1 and 2 in Toronto at the Delta across from the PDAC South Convention Center. My session is on Saturday at 3 pm in the afternoon. Attendance is free provided you Register in advance. If you go to the KaiserResearch home page you can find a link to register for this conference which is free. The two companies in my session are PJX Resources Inc and Silver North Resources Ltd. Hopefully attendance this year will not be compromised by a major snow-storm as happened last year.

Anybody visiting my web site will notice a couple differences, one annoying, the other gratifying. The annoying change is that when you arrive you will encounter a Cloudflare captcha designed to identify a human visitor. Most of the time you just have to wait for 10-20 seconds while some algorithm hoovers up your browser history and tries to figure out if you are sluggish enough to qualify as a human. But sometimes you need to click a box which presumably the hyper-efficient bots cannot figure out how to do. Once past this annoyance you get to experience the gratifying difference, namely that pages requested load quickly.

The KRO web site, even though hosted in the cloud, had become horribly sluggish because of bot traffic during the past year or so, but even more so this year. This is not because John Kaiser is flying high as a resource junior guru and the site is being pounded by eager investors, for in fact after a decade plus bear market for the resource juniors he is flying at the lowest elevation in his entire career as an independent commentator. In fact, things are so bad that all annual individual KRO memberships now expire on December 31, 2024 so that he can decide to discontinue KRO as an open fee based subscription service at the end of this year if there is no turnaround. Existing members get to renew at the annual fee of USD $450 prorated for the days left in the year, while everybody else, new and lapsed members, have to pay $450 for the remainder of the year. That is still a deal because if I decide to continue for at least another year, all members expiring at the end of 2024 will be entitled to renew at the $450 annual rate while everybody else will have to pay $200 per month on an auto-renewal basis.

The bot activity that has bogged down KRO and made it difficult for me to market it as a time saving research tool appears to be partly of a Russian nature, possibly trying to inflict a denial of service as punishment for my thumbs down commentary about the Global East and the way PutinXi Poodles are supporting the autocratic leaders Putin and Xi in their plan to flush democracy down the toilet. My main evidence for a Russian origin is the nature of the garbage that populates fake registrations which manage to get past obstacles human users cannot. These registrations fail because there is another step required for completion, such as paying with a credit card. Since the Cloudflare captcha test has been activated there have been zero bot registrations.

A less pernicious type of bot activity that is still capable of overloading a web site comes in the form of AI bots trying to hoover up data to feed their large language models. In the good old days two decades ago the more useful free content a site would provide, the more the site would show up in search engines, and the more "eyeballs" one's site would attract. So I provided a lot of useful free information, not because the site was serving advertisements to visitors for which KRO got paid, but because I hoped a fraction of the visitors would become paying members. The "knowledge" fee based model, however, died during the past decade; today "independent research" increasingly subsidizes itself with corporate sponsorships.

For example, NWT lithium explorer Li-FT Power Ltd announced on January 8, 2024 that it had engaged New Era Publishing Inc to provide social media marketing services for USD $625,000 up front to identify "an appropriate space for the campaign", with another USD $625,000 to be paid when the campaign begins. That is an investor relations expense of almost CAD $2 million. The press release mentioned that New Era principals had bought stock and promised not to sell any stock "during the active period of the campaign". Oddly, Li-FT does not disclose anything about the duration of the "active campaign". There was also no mention of the relationship between New Era Publishing Inc and Marin Katusa who publishes Katusa Resource Opportunities available at an official annual fee of $3,495 (do not click on the "subscribe" link on his web site unless you have a pending colonoscopy whose food consumption prep rules you suddenly ignored and which act you wish to abruptly reverse). This subscription service which Marin calls "KRO" published a 27 page lithium focused report on January 3, 2024 in which Marin boasts that he purchased CAD $1 million (USD $625,000?) worth of Li-FT stock which company he endorses throughout the report. The report finishes with a disclosure that Katusa, New Era etc own shares in the "following" stocks mentioned in the report "above" which list strangely does not include LIFT. From what I have seen of Katusa's reasoning much of it makes sense and is often innovative, but when you connect the dots getting compensated exclusively for that analytical output is not what his "KRO" appears to be about.

Since the real KRO is a research platform where speed is critical, and AI bots scavenging everything they can encounter to feed their large language models so they can eventually replicate whatever potential knowledge resides within KRO without paying any compensation to the source of the information are bogging down the web site, I have started shifting much of its content behind a paywall. Eventually most of KRO will be invisible to the public except for a peephole such as Kaiser Watch provided to the public for free. If this Cloudflare Captcha continues to keep the bots at bay and make the site fast for humans, KRO has a serious chance of staying alive for 2025 because it will be able to function efficiently as a research platform for sophisticated investors.

I will spend Sunday through Tuesday at the PDAC looking for bottom-fish to add to my 2024 Collection as well as to catch up with all the lithium juniors which are still struggling to get market respect despite some getting James Bay drill programs underway. Hopefully I will have a Kaiser Watch lithium focused update ready for March 8. The lithium carbonate price decline has stopped but it is too early to call a bottom despite talk that even Chinese lepidolite producers are questioning the wisdom of operating at a loss. There is lots of negativity about the energy transition these days, especially with the prospect that Trump might be the president in 2025 and will do what he can to reverse or stall the energy transition.

But there is a new wrinkle which could give legs to energy transition goals and the required metals, which is the Artificial Intelligence (AI) juggernaut. Most of the attention is on hardware producers like Nvidia and the tech giants developing AI tools with the hope of collecting huge revenues through the rental of these tools. (KRO's information platform is a tool rental service which has potential to feed an AI large language model.) Wiping out white-collar jobs by instantly delivering existing answers to questions will be a lamentable outcome that raises the question, what will all those displaced humans do in order to earn the income that is to be paid for the fruit of AI?

When machines first arrived during the industrial revolution there was great concern about displaced manual workers, but they ended up becoming engaged not just in running the machines but also in clerical and marketing work, much of it still manual. When the personal computer and internet innovations arrived these workers found a lot more new jobs as knowledge workers. But AI threatens to replace these knowledge workers, and the question emerges, what is the activity beyond knowledge generation or activation once it is more efficiently done in the digital realm that humans can do which adds value to the economy? Human interaction is one obvious path, which can take place in the cognitive realm such as interpersonal engagement between a payee and a payer or in the physical realm such as changing the diapers of aging boomers. But that doesn't really scale because it is just an end times scenario.

For humanity to thrive on the back of the AI revolution there need to be massive efficiency gains in the material world, not just the cognitive world. AI's potential to create new knowledge is the key to the AI dream. When AI uses vast computational power to work through countless inorganic molecule or crystal configurations to end up with a new group with unprecedented physical properties, who knows what technology innovations will emerge? The same goes for organic molecules and the implications for health, food production, and even rebalancing out of kilter eco-systems. AI will generate huge numbers of probability qualified hypotheses which will have to be tested with prototpyes in the physical world. Yes, AI will do much of the work with computer simulation, but at the end of the day physical testing is unavoidable. There will emerge huge demand for technicians to manage all these physical tests because this will be cheaper than machines creating endlessly recursive sensor systems. The biggest prize lies in the field of energy, with fusion the primary dream for reducing the physical cost of energy production. But there is also room for energy efficiency gains through the deployment of new materials, both in what they do and how they are manufactured. Collapse the cost of energy and all sorts of human activity becomes worth compensating for. But marching AI toward this fusion equivalent energy breakthrough will require an awful lot of energy, and this is the key to reviving the resource sector, in particular the resource juniors.

I recently read Neal Stephenson's novel Fall: or Dodge in Hell where the unexpected death of a tech billionaire results in some version of his brain being uploaded into the digital realm. This novel, which seems like a series of barely related stories, is fascinating because it posits the idea that when a person dies his or her consciousness can be migrated into the "cloud" where it can thrive within a simulated digital reality, provided the deceased has enough accumulated wealth to pay the admission cost for this after-life (a boomer wealth transfer mechanism?). Although most of the novel plays out in this simulated after-life where the deceased become free agents in so much as this is possible in any social setting, a subtext is what unfolds in the still physical world of living humans who are responsible for procuring the future souls (clients) for this simulated after-life as well as building the infrastructure to support it. Spying on the denizens of the simulated after-life itself becomes a form of entertainment that serves as an economic foundation for the living humans. Computation, however, requires energy, and the energy demand of this simulated reality goes through the roof because of the continuous flow of newly deceased members and the growing complexity of their interactions within the simulation. The result is a massive expansion of earth's energy infrastructure, which includes establishing giant solar panel fields in space. Unlike Stephenson's "hard-science" novel "The Seven Eves", he does not get into the mechanics of this because it is a side story for the Fall. But if you take the AI bubble of which Nvidia has become the monetary symbol seriously, it is not hard to realize that for AI to flourish we will need to build a lot more energy infrastructure, and because the AI boom is happening now, and not in 15 years like the fusion dream, this capacity expansion has to be done with existing technology.

The AI dream's potential to provide rapid efficiency gains for the material world, a variation of Ray Kurzweil's dream of the approaching singularity, stands in stark contrast to the energy transition goals which require near term sacrifice borne mostly by boomers who will largely not live to experience the benefits of stopping global warming by shifting to an energy basis that does not generate carbon dioxide. The IEA has made predictions of the raw materials required to make net zero emission goals reality, which includes metals like nickel, copper, rare earths and lithium which require respectively supply gains by 2030 of 100%, 50%, 200% and 600%. But while interest in lithium had a boom during the past couple years, the market has not taken seriously the reality that the current development pipeline will not deliver this supply. Despite all the corporate presentations loaded with talk about "battery" metals and their future needs, investment capital is not going into exploration and development anywhere near the scale and diversity needed to make those supply goals reality. And the reason is very simple.

People do not believe it is necessary, do not believe that it will make a difference, or may even not care what the outcome of energy transition strategies might be. Since the decision making power and capital resides in the hands of the boomer generation, which will have to make the greatest sacrifice for an outcome most will not experience, the inclination is to oppose or stall the costs of the energy transition. Never mind that they may have children or even grand-children; this generation was once called the Me generation and that probably hasn't changed. The political inclination is to take one's chances and pray or hope for the best. This, of course, does not sit well with the younger generations who along with their children will experience the outcome in full. The energy transition is a hard sell for spending huge amounts on transforming energy infrastructure into a clean foundation that slows global warming which science minded people who have not slid to the bottom of the Belief Horeseshoe recognize is laying the foundation for a dysfunctional and apocalyptic future society.

While the energy transition dream has negative connotations (sacrificing now to prevent something future bad from happening that may or may not happen), the AI dream is the complete opposite. It does threaten potentially bad future scenarios such as the extermination of humanity that may or may not happen, and which certainly is not an overnight threat, but it also offers potential near term technology breakthroughs that could make a positive difference to everybody's welfare very quickly. The only hitch is that as AI gets rolling its computational requirements will suck up huge amounts of energy the existing infrastructure capacity cannot supply.

So why not go on an infrastructure spending binge if this is the only way to make possible massive gains in human welfare? And, while we are at it, why don't we focus on building clean energy infrastructure that suits energy transition goals just in case the warnings about future calamity are correct? What is the point of all this AI innovation if we feed it with fossil fuels and the livability of the planet collapses? Unlike in the late nineties when the dot-com boom sucked all the air out of the room for the resource juniors, this time around the new AI boom could pump oxygen into the resource sector. Throw in the geopolitical reality that the Global East is in a showdown with the Global West to dominate the future, how is it possible for the resource sector not to boom, and, by extension, the resource juniors which are key to finding and advancing new discoveries in jurisdictions that are secure for the Global West? |

Five Year Chart of Nvidia - $2 trillion market cap |

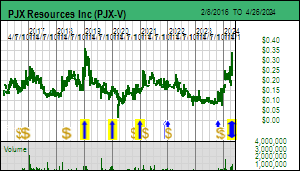

| Jim (0:09:26): Did you not just have PJX Resources at the recent January Metals Investor Forum in Vancouver? |

PJX Resources Inc was part of my session at the Vancouver MIF so Kaiser Watch fans will already be familiar with that story, which is that the century long hunt for Sullivan Two could finally deliver success in 2024 when drilling starts at the Dewdney Trail project in southeastern British Columbia. Not much will change in terms of fundamentals until drilling gets underway in June, though we may see new interpretations of existing geophysical data between now and then. Confirmation may take a couple months of drilling because the outcropping horizon they found late last year is interpreted as peripheral to the likely vent center for the Sedex system. The reason for his assessment is that zinc-lead-silver mineralization in the outcrop is non-magnetic compared to the boulders found in the talus at the base of the slope to the south. The magnetism is caused by pyrrhotite, an iron sulphide which tends to be part of the massive sulphide pile that builds up over the vent. So the drilling strategy will be one of starting with the outcropping horizon to develop an understanding of the stratigraphic controls and vector towards the area above the talus field. Meanwhile field crew will continue to prospect upslope from the talus field to try to find the erosional windows within the syenite dyke sheet from which the magnetic massive sulphide rocks spilled. If they are successful the drill will likely be moved to test the stratigraphy where the greatest potential for a major discovery resides. That is why discovery hole confirmation that sends the stock through the roof is not likely until August.

It is interesting that Adam Travis' Coast Copper Corp has staked 5,134 hectares on the eastern flank of the 13,500 ha Dewdney Trail property. I asked PJX CEO John Keating why PJX had not expanded its property to include this area. His response was that the rocks in this direction are Cambrian aged which is significantly younger than the rocks that host Sullivan as well as the outcrop stratigraphy which is slightly younger than the Sullivan Time Horizon. He does concede that Coast Copper's Sully property is prospective for the younger 150 million year old or so intrusions that PJX was chasing at the start of the 2023 field season.

The soil geochemistry at Dewdney Trail and the deep geophysics suggests that there is a lot going on in this area in terms of younger intrusive activity that never made it to surface except in local instances like the syenite dyke sheet which PJX explored last year. These would have created copper-gold systems rather than the much older zinc-lead-silver Sullivan type Sedex systems from 1.5 billion years ago. There is no guarantee that the Sedex target will turn out to be Sullivan scale, or even half that, but there will be enough visuals during exploration to fuel anticipatory speculation that could enable PJX to raise a lot more money at higher prices. Some of that money could be used to drill these deeper blind targets, and if these deliver evidence of the intrusion related gold systems Keating thinks the structural framework in this area made possible, not only would that turn Dewdney Trail into two distinct exploration plays, but it would also spark interest in Coast Copper's Sully property to the east. But that is getting ahead of ourselves. Normally I do not allow a junior to be part of my session in successive MIF conferences unless something dramatic has changed, but this story is so interesting that I felt the Toronto audience should have a chance to see it. The Dewdney Trail Sullivan Two hunt could turn out to be a huge discovery play whose serendipitous origins would be an inspiration for all serious discovery oriented exploration juniors. |

PJX Resources Inc (PJX-V)

Bottom-Fish Spec Value |

|

|

| Dewdney Trail |

Canada - British Columbia |

2-Target Drilling |

Zn Pb Ag |

Regional Map & PJX Property Map |

Geology Map showing Sullivan in relation to potential Sullivan Two |

Deedney Trail Map with Coast Copper claims |

Magnetic Geophysical Map for Dewdney Trail |

Sample Results for Dewdney Trail |

Photo View of Sullivan Two Target |

Conceptual Section showing location of dyke relative to stratigraphy |

| Jim (0:17:03): Why have you invited Silver North Resources to the Toronto Metals Investor Forum? |

Silver North Resources Ltd, headed by CEO Jason Weber and chairman Mark Brown, holds 100% of the strategically located Haldane project in the Yukon west of the Keno Hill silver-zinc-lead mine operated by Alexco until Hecla Mining bought it out in late 2022 for $100 million in stock. Hecla, which also paid more than double that to buy out Wheaton's silver stream, is now working to bring mining supply to the existing mill's capacity. Alexco, which took on the Keno Hill project with a promise to undertake reclamation of the district's legacy waste from a time when environmental mitigation rules were weak or non-existent, a legacy for which the exploration and mining sector continues to get a bad wrap today despite a completely different permitting regime, sold the silver stream early on because its geologists believed that at depth the Keno Hill veins would undergo an increase in zinc-lead grades at the expense of the silver grade. That proved not to be the case and Alexco ended up struggling to make its Keno Hill operation profitable. Hecla's purchase of the silver stream eliminates that profit obstacle and allows it to pursue development of the deeper veins so as to bring the mill to full capacity. But it also positions Hecla in the middle of a Yukon region where Victoria Gold operated the Eagle gold mine, Banyan is advancing its Aurmac gold deposit, and Sitka Gold is drilling its own intrusion-related gold system.

Hecla's revival of the Keno Hill zinc-lead-silver district has made Haldane topical and is a key reason Silver North has shifted from the prospect-generator-farmout model to focusing on turning its flagship into a 100% owned discovery. The Keno Hill district is characterized by northeast striking veins within a quartzite host that have undergone secondary faulting which created jogs within which very high grade silver shoots have formed. The trick is to find where exactly these shoots repeat. The Haldane property covers a mountain whose oxidized portion of vein sets similar to Keno Hill has been preserved, which made the deeper sulphide extensions a more elusive target for past explorers. The prevailing view is that Haldane Mountain is an upwards horsted block which, if true, implies that substantial down dip potential exists beneath the mountain and will be accessible from the surrounding valley floor. Alexco's silver stream mistake is thus a reason to revisit Haldane in a big way.

High grade silver was mined at the southern end but the project has seen only 28 drill holes, half of them conducted by Silver North. This drilling has confirmed multiple mineralized veins similar to those at Keno Hill; the spacing of the holes was such that only 600 m of cumulative 12 km strike has been tested. The hypothesis is that denser drilling will reveal the location of high grade shoots which can grade above 3,000 g/t silver, for which Silver North would like to mount a $2 million program in 2024 that is only partly funded so far. The goal is to delineate 30 million ounces silver, which is not enough on a standalone basis, but which would be of great interest to Hecla as ore trucked to its Keno Hill mill.

Silver North has also farmed out its Tim project in southern Yukon to Coeur Mining which can earn 80% by delivering a positive feasibility study by 2028. The original deal was done nearly 5 years ago and Coeur was in danger of defaulting thanks to lengthy delays getting a drill permit. The project sits within overlapping territories of the Liard and Ross River First Nations of which Ross River has not been enthusiastic about mineral exploration. The permit was granted in 2023 but too late for Coeur to mount a drill program. Given the desire to focus on the 100% owned Haldane project Silver North agreed to extend the original deal to 2028. With permits finally in hand Coeur will be drilling Tim in 2024 with the benefit of knowledge it has gained developing the Silvertip carbonate replacement type silver-zinc-lead project on the BC side. Haldane's location in the middle of an area where intrusion related gold systems owned by Victoria Gold, Banyan and Sitka Gold are now believed to be the drivers of the slightly younger peripheral Keno Hill Ag-Zn-Pb veins makes Silver North a potential buyout target for more than just Hecla Mining. Hecla and Coeur are arch rivals vying for the attention of silver bugs. If Coeur has another Silvertip scale success at the Tim project it will want to acquire Silver North sooner than later, which would put Haldane into its hands. That in turn would stymie any ambitions Hecla might have to develop the Haldane vein shoots Silver North delineates and truck them to its Keno Hill mill. Although Silver North still needs to do a major financing to fund a serious summer drill program, the changes in the strategic implications of Haldane for this part of the Yukon is the key reason I invited Silver North to the 2024 Toronto Metals Investor Forum. |

Silver North Resources Ltd (SNAG-V)

Bottom-Fish Spec Value |

|

|

| Haldane |

Canada - Yukon Territory |

2-Target Drilling |

Ag Zn Pb |

Keno Hill District and Vicinity Map |

History of past Haldane exploration activity |

Geoogy of Keno Hill Silver-Zinc-Lead District |

Mineralizad Faults at Haldane |

Previous Haldane Results |

| Disclosure: JK does not own any of the stocks mentioned; PJX Resources and Silver North Resources are Bottom-Fish Spec Value rated |